The knowledge baseIndustry insights

Analysis and insights for leaders navigating real estate and private markets. Focused on modeling, risk, and the infrastructure behind better decisions.

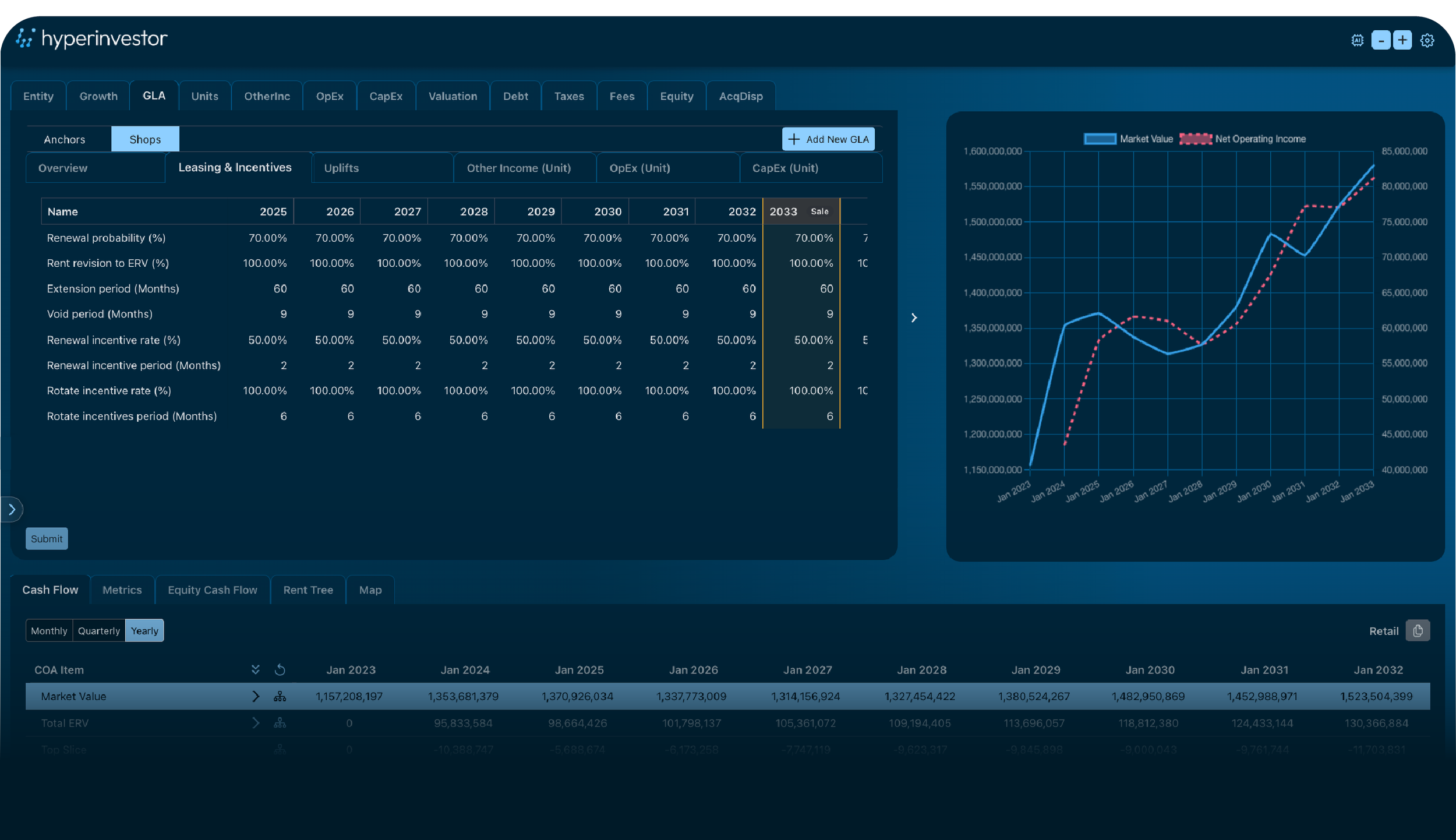

Why Real Estate Investment Modeling Breaks Down at Scale

As real estate portfolios grow, spreadsheet-based models become fragmented, fragile, and increasingly difficult to manage at scale.

Why We Built HyperVal - And the Problems We’re Actually Trying to Solve

Most investment teams don’t struggle with intelligence, they struggle with infrastructure. Fragile spreadsheets quietly shape decisions more than strategy does.

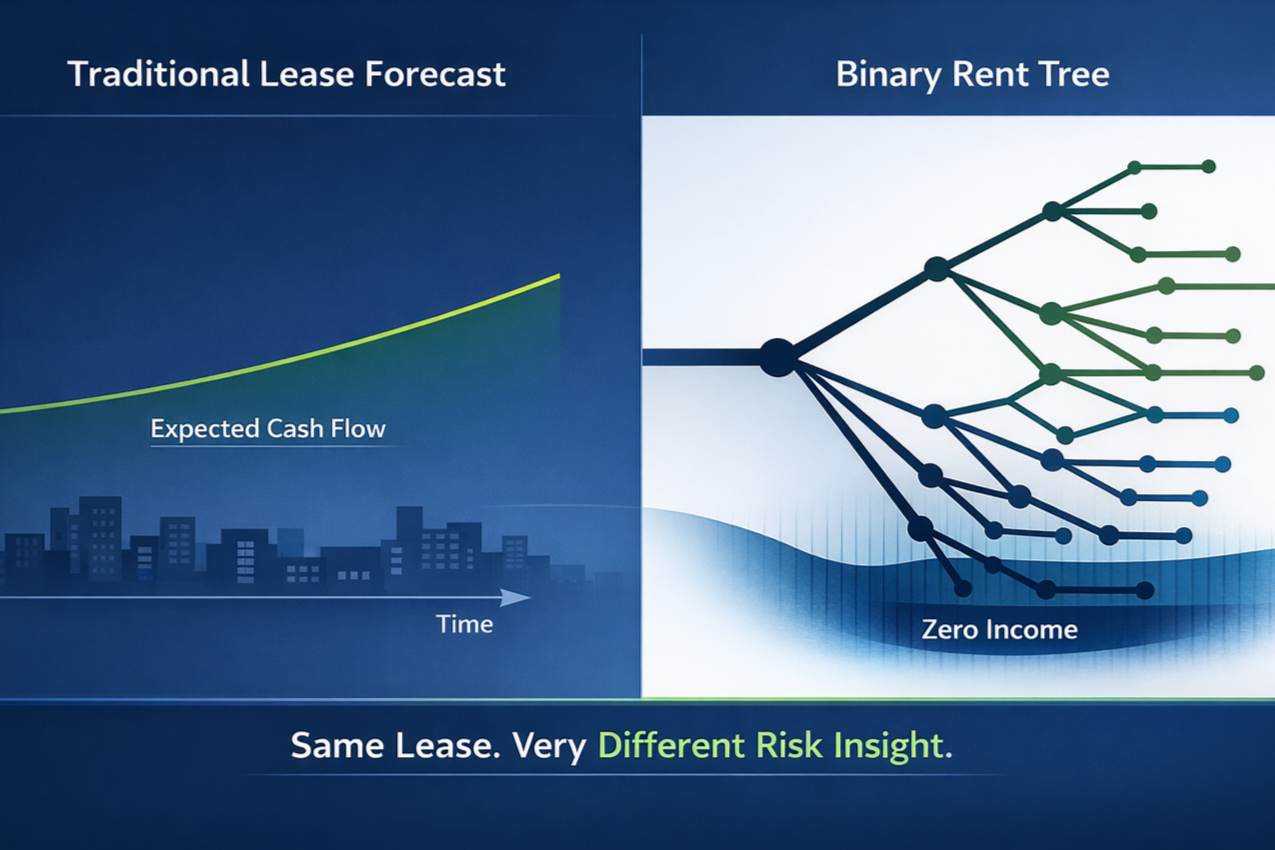

Real Estate Income has Credit Risk

Leases are rarely as stable as models assume. When renewals, downtime, and renegotiations are compressed into a single forecast, risk disappears on paper, not in reality.

From Static Models to Living Scenarios — How Event-Driven Analysis Is Redefining Real Estate Modeling

Real estate does not move in straight lines, but most models still do. As conditions change, forecasts need to reflect real-world triggers.