Real Estate Income has Credit Risk

Why Leases should be modeled like fixed income instruments

Investors want to treat income as stable and predictable. But the way we model that income rarely behaves that way. A lease is best understood as a bond with embedded options, creating a sequence of contingent outcomes.

Tenants may renew or not.

Breaks may be exercised or renegotiated.

Space may be relet quickly, slowly, or only after incentives and capex.

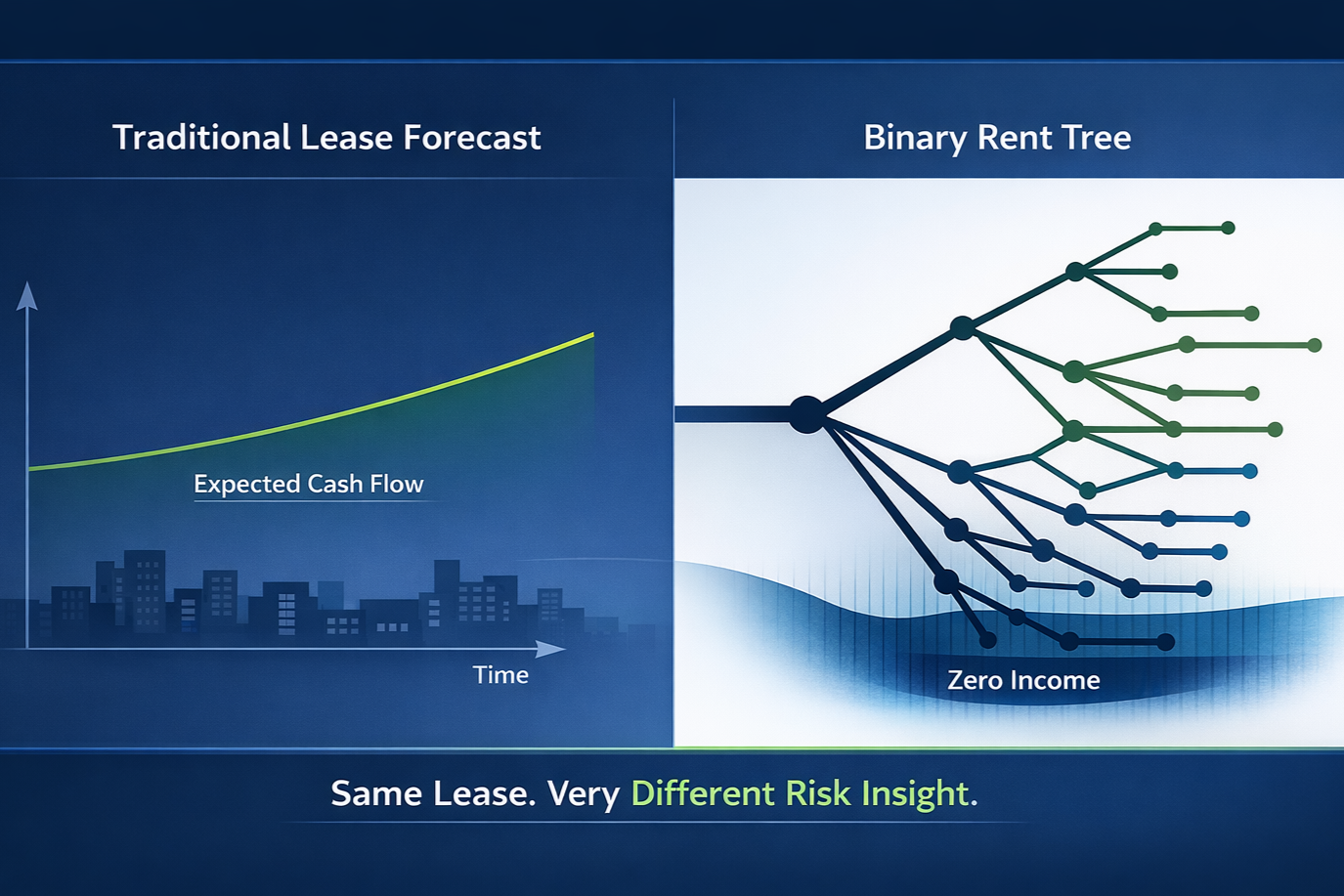

Most underwriting collapses multiple possible lease outcomes into a single expected cashflow path, with a small number of manually stressed alternatives layered on top. That approach produces a clean forecast, but it systematically hides downside risk.

To understand the true risk profile of units, assets, and ultimately funds, investors need to model not just one expected outcome, but the full range of outcomes that can realistically occur.

At Hyperinvestor, we built exactly that.

The Binary Rent Tree

Every realistic lease outcome, calculated and mapped

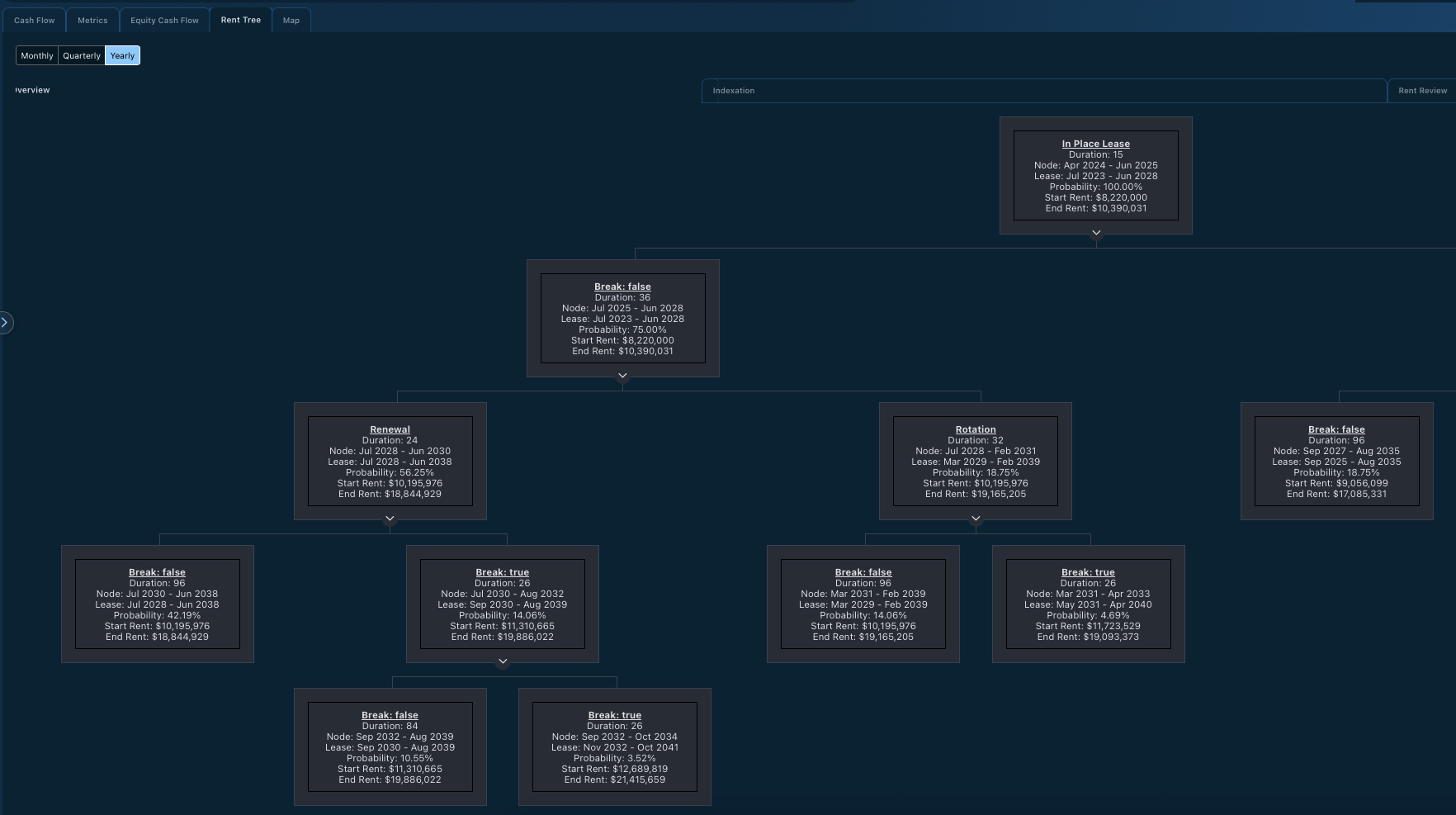

Using lease data and explicit assumptions, HyperVal constructs a Binary Rent Tree. A branching structure that captures the key decision points embedded in every lease:

Renewal or not

Break or not

Vacate or remain and renegotiate

Binary does not mean simplistic. Each branch can resolve into negotiated economic outcomes, such as rent resets, shorter terms, incentives, downtime, or staggered re letting.

Together, these branches form a probabilistic distribution of cashflows, where every path is fully modeled and internally consistent. This is not scenario analysis in the traditional sense. There is no handpicked downside case or optimistic upside case.

Every realistic way a lease can evolve over time is explicitly modeled, with timing, cashflows, and valuation attached.

When you can see the full distribution, something important becomes visible.

The left tail.

Seeing the left tail & Understanding real income risk

Most real estate forecasts report several IRRs and yields, all derived from a single underlying cashflow forecast. But that is not what investors worry about. Experienced investors do not lose sleep over the midpoint of the distribution. Their concern lies in downside exposure, the timing of income disruption, and its interaction with leverage and refinancing.The Binary Rent Tree makes that risk explicit. You can now analyse an asset or fund and say:

Here are the months where income risk spikes

Here is the full range of potential outcomes

Here is the probability that income falls below required thresholds

Here is where refinancing or covenant pressure is most likely

This is how fixed income investors have analysed credit risk for decades. Real estate income can now be treated with the same discipline.

A fixed income approach to property modeling

When you view leases as bonds with embedded options, new insights become available.

1. Quantify risk rather than infer it

Renewal likelihoods, break behavior, vacancy duration and re letting assumptions are explicitly modeled and visible. Probabilities are transparent, editable, and auditable, and can reflect tenant quality, market conditions, or investment committee judgement.

2. Understand when risk occurs

Traditional lease modeling smooths multiple possible outcomes into a single expected cashflow, masking the fact that some paths include periods of zero income. By modeling each path explicitly, income risk becomes visible in time rather than hidden inside a single metric.

3. Value at the lease and unit level

Each path has its own value, enabling genuinely granular valuation and attribution.

4. Improve investor confidence through transparency

Investors do not just see a base case. They see the distribution and its drivers.

This allows investors to manage model risk alongside asset risk. It’s not about predicting the future. It is about understanding the uncertainty that shapes it.

Screenshot from a lease in the Binary rent tree in HyperVal

Why this is hard and why it is rare

Building a tree for every lease, unit, asset, and fund is:

Computationally intensive

Architecturally complex

Difficult to keep performant

Challenging to audit

Nearly impossible to visualise in spreadsheets

HyperVal’s calculation engine was built specifically for problems like these.

Every branch. Every path. Every outcome. Calculated in nanoseconds and fully traceable.

This capability remains largely absent from institutional real estate tooling.

From forecasts to risk profiles

With the Binary Rent Tree, investors stop asking: “What is the expected cashflow?”

And start asking:

With what level of confidence can I expect to receive this level of cash flow?

What is the risk adjusted cashflow?

Where are the structural weaknesses?

Which leases dominate the downside?

How deep is the downside and when does it occur?

This fundamentally changes conversations with investors, lenders, and ICs.

You are no longer presenting a forecast. You are presenting a quantified risk profile.

From deterministic models to distributions

Once every lease behaves as a distribution, and every unit, asset, and fund inherits that distribution, the portfolio becomes a living risk map. Income risk is no longer implicit. It is visible, timed, and measurable.

Life insurance offers a useful example. Insurers are not primarily focused on the expected value of future claims. They focus on whether they can meet their obligations across a wide range of plausible futures. They model distributions to ensure that, even in adverse scenarios, liabilities can be covered when they fall due.

Real estate income is no different. Investors and lenders ultimately care about whether income is sufficient to service debt, fund distributions, and support long term obligations through different market conditions.

That requires understanding not just expected cashflows, but downside risk and its timing. When investors can see that risk clearly, uncertainty falls. When uncertainty falls, capital allocation increases.

The managers who can demonstrate resilience rather than optimism are the ones who attract and retain long term capital.

With the Binary Rent Tree, Hyperinvestor helps you get there.

See what your income risk actually looks like

Get in touch to see how HyperVal models real lease outcomes and

exposes downside risk across assets and funds