From Static Models to Living Scenarios — How Event-Driven Analysis Is Redefining Real Estate Modeling

Financial models in real estate haven’t evolved much in decades. Most remain static spreadsheets, impressive in complexity, but fragile in practice. A single hard-coded cell can break an entire valuation, and every assumption update triggers hours of manual edits across countless files.

HyperVal was built to change that.

At its core lies an event-driven modeling engine, a framework where every assumption adjusts automatically as conditions in the model evolve.

Why Event-Driven Modeling Matters

Traditional Excel or tooling workflows are built on fixed timelines: “rent starts here, cost increases there.”

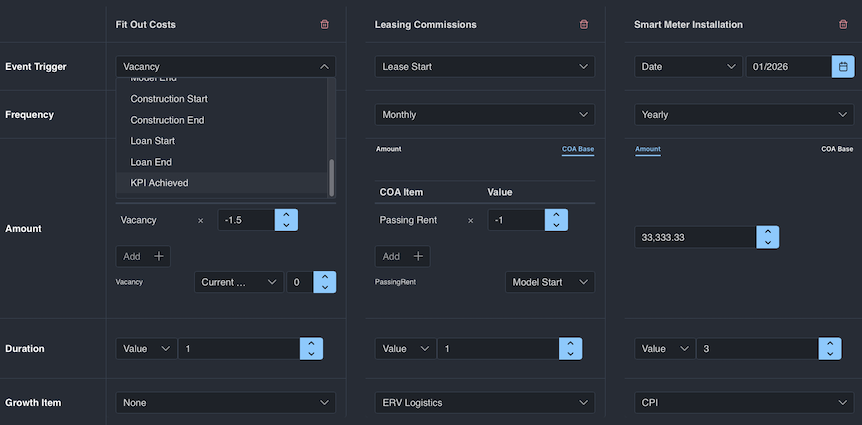

But asset performance doesn’t follow a schedule, it reacts to events. A tenant vacates. A KPI is reached. A construction phase ends. A market value threshold is hit. In HyperVal, those events become live triggers that cascade through the model:

A void triggers leasing commissions and incentives.

Hitting an occupancy KPI activates additional OpEx.

Shifting a sale date instantly updates debt retirement, fees, and cash flows, whether on the asset or fund model level.

Instead of manually adjusting cells, analysts define relationships, and the model updates itself as assumptions evolve.

When Scenarios Become Stories

This event-driven logic turns scenario analysis into something far richer. Because events can occur or not occur across different cases, every scenario unfolds as a distinct storyline of what could happen to an asset, and how this impacts the fund.

A vacancy may trigger a cost spike in one case, or never occur in another.

A KPI might be reached earlier under a high-growth path, unlocking refinancing sooner.

Each what-if now alters not just numbers, but sequences of cause and effect. Scenarios stop being static tables of assumptions, they become dynamic narratives that reflect how assets behave under uncertainty, far closer to reality. For asset managers, this dynamic logic doesn’t just describe outcomes, it enables action. Teams can test mitigation strategies in real time and respond instantly to shifting conditions.

Event-driven modeling turns passive forecasting into active asset management.

Example of HyperVal’s Operational Expenses per Lease

From Stories to Strategy

Once a model behaves like a system rather than a spreadsheet, new analysis becomes possible.

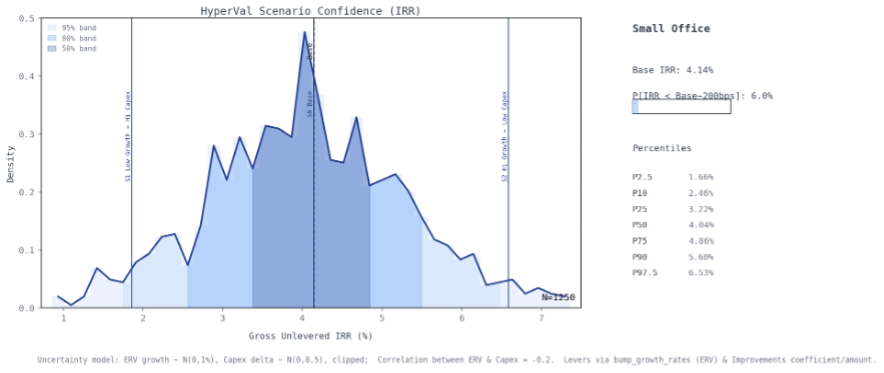

Teams can run dozens of scenarios, downside, base, ESG upgrades, cap-rate sensitivities, in seconds. Scripts can iterate through growth, yield, and exit assumptions to generate heatmaps or confidence intervals.

Financial modeling shifts from a static forecast to a living simulation of an asset’s future.

Users can ask:

“What happens if ERV growth lags 50 bps?”

“At what market value can we refinance?”

“How much CapEx is justified by an ESG uplift?”

The answers appear instantly, and visually.

Investment teams can re-run every asset model each quarter by simply shifting start dates and importing updated rent rolls and HouseView assumptions, no manual setup required.

The result: faster answers, hours saved, cleaner risk analysis, and better allocation decisions.

From Strategy to Insight

Combined with HyperScript, HyperVal’s built-in Python scripting engine, and integrations with tools like Power BI or Tableau, the same scenario data can feed dashboards, compare versions, and power ESG or fund-level analytics. It bridges underwriting, valuation, and asset & fund management in one continuous system, finally uniting what Excel kept apart.

This script simulates 1,250 variations in ERV Growth and CapEx intensity to show the Gross Unlevered IRR distributions across scenarios - in less than a minute…

The Result

Event-driven, scenario-aware modeling is not just about speed, it’s about clarity and realism.

It lets teams model the way they think: in causes and effects, not rows and columns.

When every what-if can unfold through real events, strategy becomes continuous rather than periodic, and modeling turns from bottleneck to competitive advantage.

Real estate is too dynamic for static spreadsheets. If you’d like to see how event-driven modeling can change how your team operates, let’s talk, we’d love to show you.

See HyperVal in action

Experience event-driven modeling first-hand.

Let us show you how our platform can streamline your workflows and empower informed, data-driven decisions.