Faster Models.

Smarter Investments.

Financial modeling software for real estate and private equity investment managers.

Use casesOne system. Every scenario.

At Hyperinvestor Technologies, we understand the complexities of managing investments. That’s why we created HyperVal, the financial modeling engine for smarter decisions. Built for real estate and private equity investment managers, it handles everything from single asset or development models to full fund forecasting. Whether you're budgeting, managing investor data, or preparing reports, HyperVal keeps your models connected, fast, and accurate. Explore what you can do - all in one platform.

Advanced capabilitiesAccelerate your thinking. Automate your process.

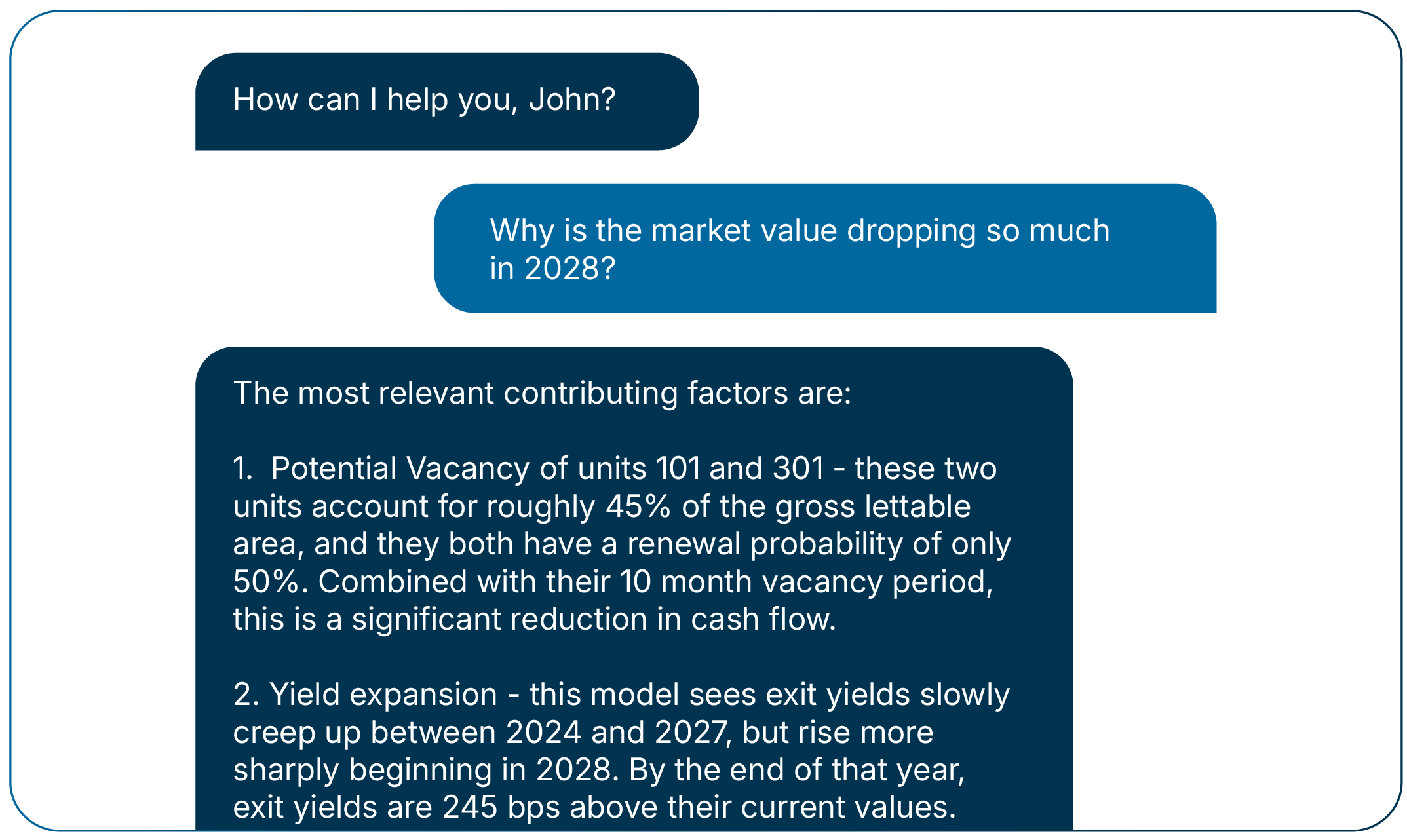

AI integration

Ask in-depth questions and have HyperAnalyst walk you through the calculations behind your numbers.

Drag in your Rent roll or Investment Memorandum PDF and set up your underwriting model in seconds.

Use HyperAnalyst to run scripts that adjust assumptions or deliver the outputs you need.

Quickly learn how the platform works by engaging with the AI instead of browsing help guides.

Scripting engine

Tailor the platform to your team’s exact needs. With HyperScript, custom scripts can be created for your specific workflows, from bulk updates to scenario runs. Once written, they can be reused by your team to automate repetitive tasks and eliminate hours of manual work.

Key featuresThe modeling layer for real estate and private equity investment teams

-

Modeling at scale

Standardize lease assumptions across your models with the power of the global house view.

Stay consistent across assets & developments while adapting to strategic portfolio-level decisions.

-

Unit-to-Fund modeling

Trace performance from the unit level to investor distributions, without switching screens. HyperVal connects asset and fund models in a single system for consistent, end-to-end forecasting.

-

Scenario planning & stress testing

Explore different scenarios by adjusting key assumptions and levers. Compare outcomes to make informed, confident decisions.

House view

Set and enforce global assumptions, like inflation, FX, or discount rates, across all models in one place.

Actuals & Inception returns

All historical cashflows feeds straight into the model, showing true performance since inception.

Equity waterfall

Model joint ventures and equity structures. Set up tiers, hurdles, and custom distributions.

Multi-currency support

Model global portfolios with automated currency conversion and consolidation.

Custom outputs

Create investor-ready exports tailored to your reporting structure, metrics and visual standards.

Event-driven modeling

Instead of manual timelines and formulas, the model is driven by events. Explore how different scenarios unfold

Side calculations

Add one-off calculations, right in your model, with the same flexibility you’re used to in Excel.

Scenario comparison

Compare strategies side by side and instantly understand the impact of changing assumptions.

Who we cater toEmpowering leaders in investment management

Our platform HyperVal supports professionals across private equity, real estate, lending, appraisals, and research. From fund managers seeking efficiency to IT leads managing budgets, our platform delivers the flexibility and precision needed to drive results in today’s competitive market.

Whether you're modeling a single asset or overseeing an entire portfolio, HyperVal adapts to your needs. It's built to support both strategic decision-making and operational excellence.

Investment Managers

Real Estate

Appraisers

Private Equity

Infrastructure

Capital Markets

Research

Lenders

Ready to maximize your portfolio’s potential?

Experience financial modeling that adapts to you. Let us show you how our platform can streamline your workflows and empower informed, data-driven decisions.